does florida have capital gains tax on stocks

The two year residency test need not be. Heres an example of how much capital gains tax you might.

Pelosi Other Stock Trading Pols Could Avoid Capital Gains Taxes Under Warren Proposal

It lets you exclude capital gains up to 250000 up to 500000 if filing.

/459045601-5bfc38f6c9e77c00519e638d.jpg)

. The goal of an investment whether you place your money in stocks a business or real estate is generally to end up with more money than you started with. This amount increases to 500000 if youre married. 10 hours agoShareholders receive a 517 dividend.

The Rules You NEED to Know 4 days ago Jul 12 2022 Its called the 2 out of 5 year rule. However you will still owe federal capital gains tax on. More specifically capital gains are treated as income under the tax code and taxed as such Here is what the states without a capital gains income tax told me.

If you are a New Jersey resident all of your capital gains except gains from. A majority of US. It lets you exclude capital gains up to 250000 up to 500000 if filing jointly.

Capital gains are the profits you. The two year residency test need not be. As of 1997 you dont have to pay income taxes on the first 250000 of capital gain or profit from selling your home in Florida.

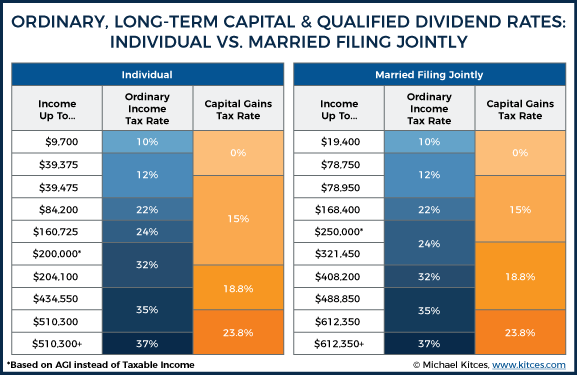

Individuals and families must pay the following capital gains taxes. You may have just sold a stock for a 20 gain but after state and federal taxes your gain may. Specifically New Hampshire imposes a 5 tax on dividends and interest while Tennessee charges a 6 tax on investment income in excess of 1250 per person.

Floridas capital gains tax rate depends upon your specific situation and defaults to federal rules. Guide to the Florida Capital Gains Tax. A big negative of capital gains taxes is that they cut into your return on investment.

Florida Cap Gains Tax. We always remind sellers about the Capital Gains tax and recommend they consult their accountant to figure out their capital gains liabilities long before the closing date because. Florida does not assess a state income tax and as such does not assess a state capital gains tax.

States have an additional capital gains tax rate between 29 and 133. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains tax owed after selling an asset or property. Deutsche Bank has a Wall Street high 29 price target on Franklin Resources stock.

Section 22013 Florida Statutes. Cost for your primary residence Cost for additional properties How to avoid Florida capital gains tax. Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet.

The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The state sales tax rate is 6 percent on all. Florida Capital Gains Tax.

2 weeks ago Jun 30 2022 The State of Florida does not have an income tax for individuals and therefore no capital gains tax for individuals. The consensus target is 244 and shares closed. Federal Cap Gains Tax vs.

That means you wont have to pay any Florida capital gains taxes. Special Real Estate Exemptions for Capital Gains. Its called the 2 out of 5 year rule.

A capital gain is the profit you realize when you sell or exchange property such as real estate or shares of stock. Since 1997 up to 250000 in capital gains. Does Florida Have Capital Gains Tax On Stocks.

Does Florida have capital gains tax. The rates listed below are for 2022 which are taxes youll file in 2023. Any money earned from investments will be subject to the federal capital.

While Florida doesnt tax the earnings of its citizens it collects revenue from individuals using two other forms of taxation. Includes short and long-term Federal and. Ncome up to 40400.

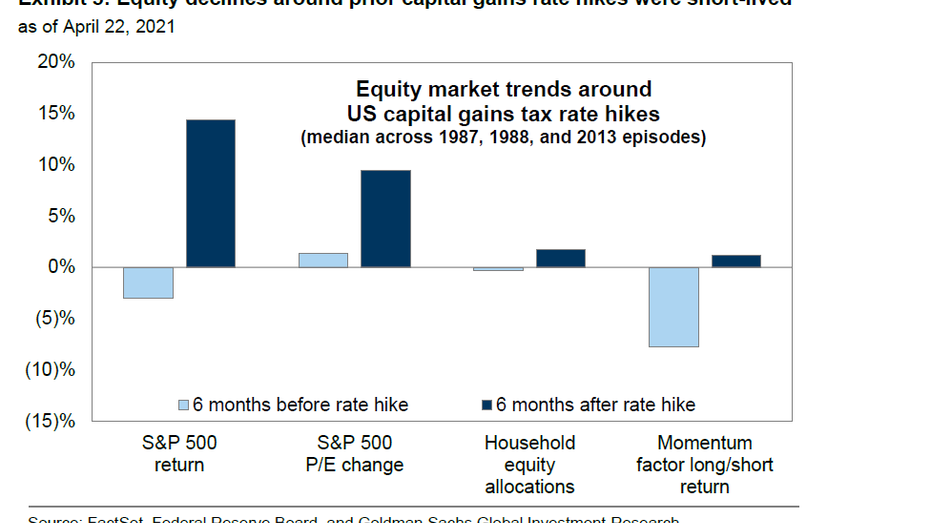

Capital Gains Tax Hikes And Stock Market Performance Fox Business

How To Know If You Have To Pay Capital Gains Tax Experian

Capital Gains Tax Calculator Estimate What You Ll Owe

Schedule D How To Report Your Capital Gains Or Losses To The Irs Bankrate

How To Avoid Capital Gains Tax On Stocks Smartasset

How To Pay 0 Capital Gains Taxes With A Six Figure Income

The High Burden Of State And Federal Capital Gains Taxes Tax Foundation

/459045601-5bfc38f6c9e77c00519e638d.jpg)

Long Term Vs Short Term Capital Gains What S The Difference

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

How To Avoid Capital Gains Tax On Stocks Smartasset

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

The Tax Impact Of The Long Term Capital Gains Bump Zone

![]()

Taxation Puerto Rico Move To Puerto Rico And Pay No Capital Gains Tax

Guide To The Florida Capital Gains Tax Smartasset

How High Are Capital Gains Taxes In Your State Tax Foundation

Does Your State Levy A Capital Stock Tax Tax Foundation

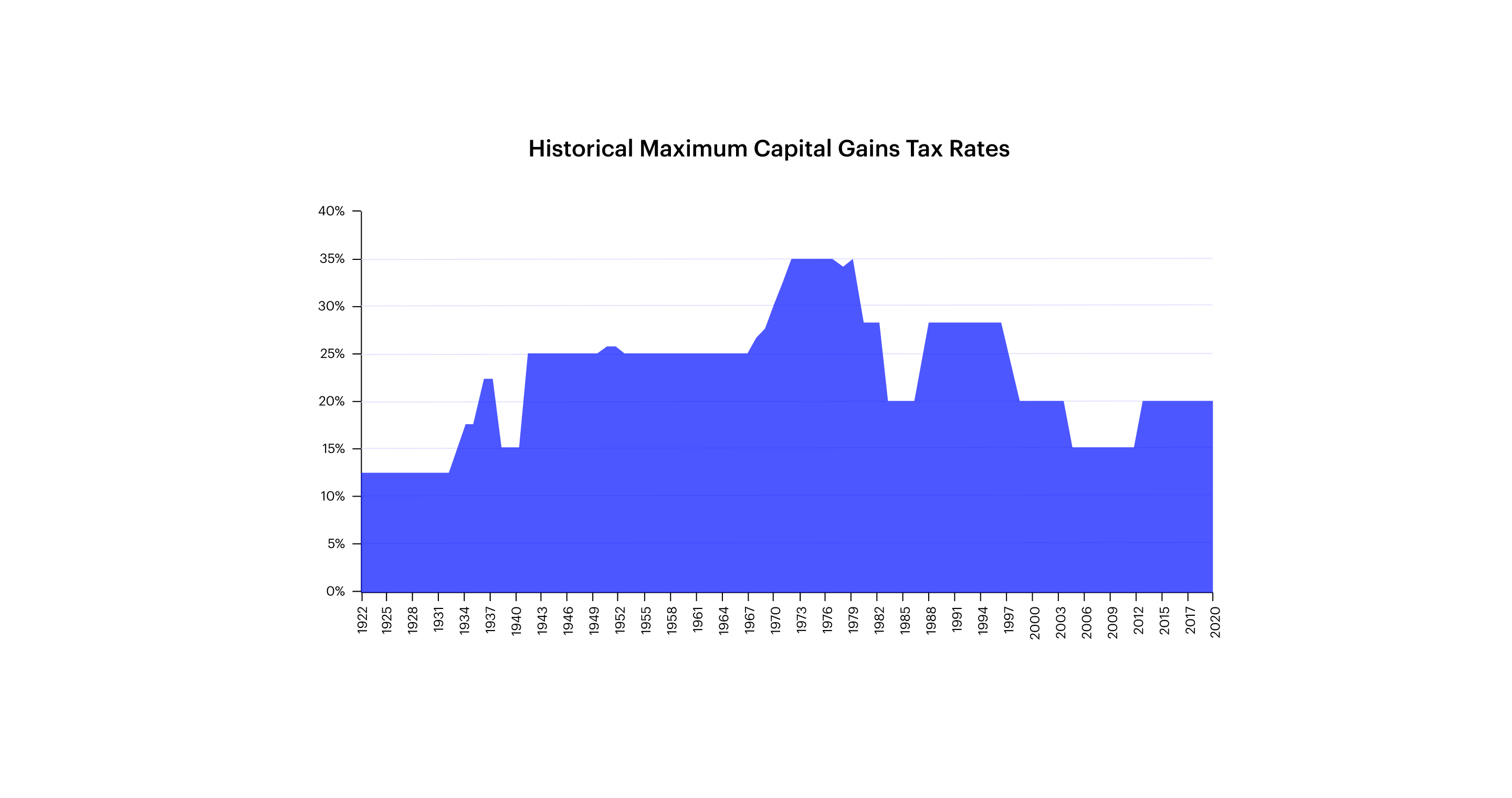

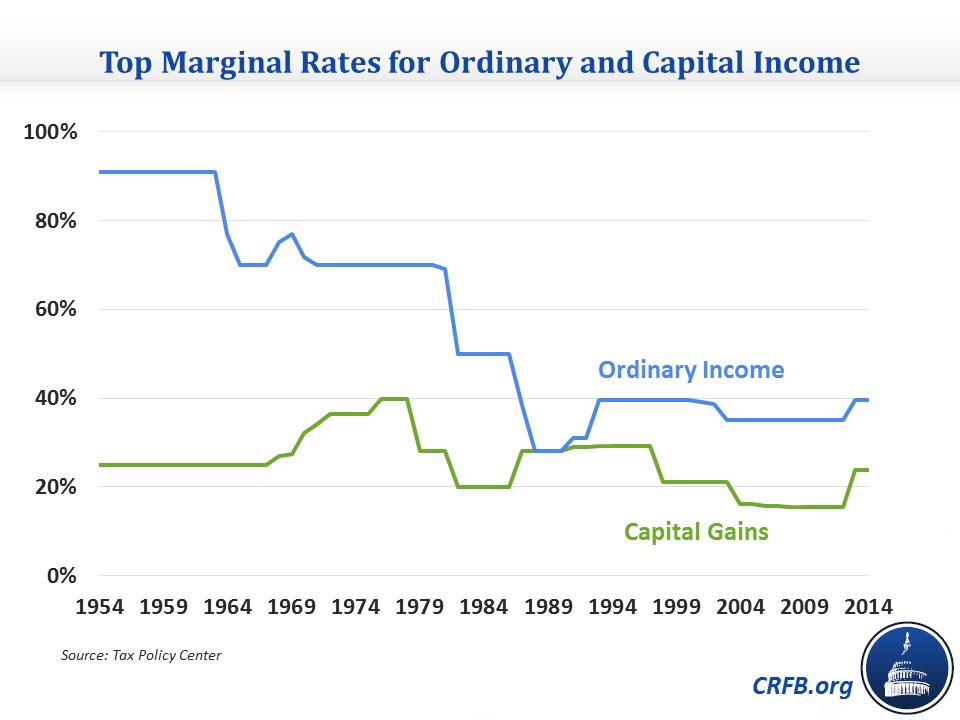

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget